The working platform and supports multi-strings exchange, improving access to and you can allowing profiles to change across other blockchain ecosystems. Full, Kraken mixes freedom, shelter, and you will representative-amicable provides to deliver an excellent change sense. Once a niche providing, today you will find all types of DEXs providing to several types of pages and you can constructed on numerous blockchain ecosystems. Programs can also be function a general list of infrastructural implementations and system buildings. Of a lot crypto DEXs render innovations in check guides, exchangeability swimming pools, or other decentralized finance (DeFi) elements such as aggregation systems to own unique and you may fresh monetary tool. Here i view several of the most common DEXs and you can what makes each unique.

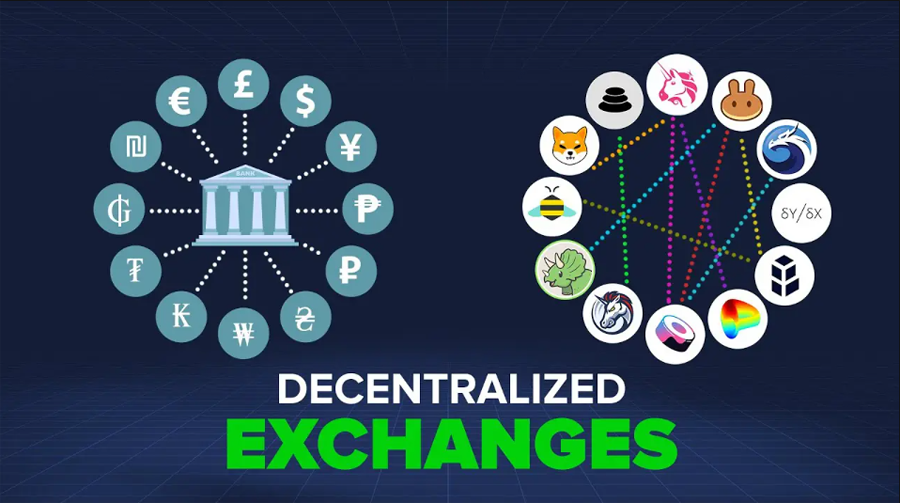

Decentralized exchanges face book challenges inside the maintaining exchangeability using their delivered nature and you can shortage of a central authority to cope with advantage circulates. To hyperliquid exchange handle these demands, DEXs have used imaginative components for example liquidity pools and automatic industry manufacturers (AMMs). Liquidity pools are supplies out of property that will be pooled along with her from the contributors, just who inturn discover area of the change costs otherwise almost every other bonuses. The program lets DEXs to keep a steady source of possessions for exchange, and thus boosting exchangeability.

Hyperliquid exchange: What’s the difference in a crypto replace and you may a brokerage?

- A good Decentralized Crypto Exchange (DEX) is a type of cryptocurrency replace you to works as opposed to a central ruling authority, enabling direct peer-to-fellow transactions.

- The main benefit of a good DEX is gloomier will set you back out of exchange and getting options for buyers that provide liquidity.

- The working platform’s peer-to-fellow change model not merely improves security from the reducing intermediaries as well as aligns to your prices of affiliate handle in the decentralized finance.

- IDEX’s part extends beyond are a good decentralized replace, actively causing the newest development away from decentralized financing (DeFi).

- Hedge Having Crypto will publish suggestions which is truthful, exact, or over-to-time.

This community-determined means fosters a feeling of ownership and collaboration, identifying SushiSwap on the Ethereum-based DEX landscaping. On the aggressive landscaping of decentralized financing, PancakeSwap’s pioneering part and you can strategic adaptations underscore their relevance inside creating the future of DEX platforms. Bancor came up since the an excellent trailblazer in the decentralized fund (DeFi) domain, introducing Automatic Field Suppliers (AMMs) to your Ethereum long before the brand new DeFi time.

- As this form of Dex spends order instructions to complement people and you can suppliers, it constantly doesn’t rely on exchangeability pools as much as AMMs, that will possibly trigger liquidity shortages.

- Central transfers render high exchangeability, quick trading performance, and customer care, leading them to best for beginners and individuals trying to find benefits.

- Inside the old-fashioned setups, storing cash on a central exchange exposes pages in order to custodial dangers, should your replace is actually hacked, so are your own fund.

- Besides that, the newest platform’s native token, BNT, facilitates prompt, effortless payments.

- Peer-to-fellow marketplaces such Bisq, Hodl Hodl, RoboSats and Peach Bitcoin assist people and you will vendors slash sale individually, instead of ID checks.

Bancor’s interface was created to getting user-friendly and you can available, catering to help you both educated DeFi users and those not used to decentralized exchanges. The working platform now offers outlined statistics for the liquidity pools and trade items, helping pages for making informed behavior. DYdX is an excellent decentralized crypto exchange that provides profiles that have complex trade possibilities such continuous deals and you may margin trading. Since that time, the working platform has become a frontrunner regarding the decentralized fund room. It initial traded to the Ethethereum blockchain, but the replace relocated to its dydX chain in the October 2023. The newest crypto marketplace is astounding, so there are numerous decentralized exchange platforms to pick from.

Curve Finance is actually a good DEX one facilitates the newest change away from stablecoins, including DAI, USDC, USDT, TUSD, BUSD, and you can FRAX. It is currently another-largest DEX regarding exchange frequency and you can TVL, along with $1.8 billion locked in its swimming pools. Discuss leading exchanges for time exchange BTC and you will altcoins which have cutting-edge have. While using the a good DEX, you will need to see the fee structure, as possible dictate your own trading behavior. SushiSwap’s background can be questionable and you may remarkable, nevertheless has created by itself much more rightly having a better framework and program in the current.

Dangers and you can Restrictions from Decentralized Transfers

Aren’t they meant to be just the right ways to difficulties with centralized exchanges? The original age group away from DEXs intended for duplicating the consumer sense away from centralized exchanges and utilized purchase guides. Yet not, including form of decentralized transfers exhibited difficulties inside the efficiency and you can had been costly and you will unproductive. It is extremely important to find out about him or her prior to deposit crypto property and you can to make purchases.

The market industry producers and liquidity company are not pleased with the new give and you will exchange costs. He’s a deal to the replace one to to have a fee, investments will be routed their method, in the liking over the most effective exchangeability supplier. The fresh growing rise in popularity of decentralized exchanges is a major focus on regarding the crypto space. He’s better, safer, and you can smaller than just central transfers.

SushiSwap Features

This enables DeFi builders to build automated change actions, arranged things, and you will chance management equipment when you’re benefiting from sub-2nd finality and you can near-no charges. Moreover, the brand new SushiSwap platform lets DeFi investors to help you use and you may lend from a big listing of trading sets. If the adequate guarantee is offered, investors is influence its credit power by the to 2x. Although this is considerably below other DeFi margin change possibilities, SushiSwap try a robust DEX to help you swap, secure, secure produce, give, borrow and you may power all using one decentralized platform. Some other expert to possess profiles is the amount of offers and you may game in which pages can be win Pie, and other tokens. PancakeSwap features constant trade tournaments, a lottery, and a forecasts middle to own playing to the if the cost of certain cryptocurrencies will increase or fall off over a-flat age of day.

Excellent Have and you will Benefits associated with Decentralized Exchanges

Since the 2006, he’s got become the leader in community progression – away from early on line gambling ecosystems in order to today’s cutting-border online game advancement systems, online streaming networks, and you can Web3 integrations. DEXs generally require no personal data from their profiles, offering a higher standard of anonymity and you can confidentiality. Deals for the a DEX don’t involve submission sensitive private information, and this draws pages concerned with privacy and the ones inside limiting jurisdictions.

Alternative produce provide distinguish legitimate systems away from unsustainable ponzi techniques providing unlikely productivity. Top quality standards create production thanks to trading costs, lending interest, and you will validator advantages rather than token pollutants you to dilute proprietor worth. The brand new decentralized fund surroundings continues to progress in the breakneck rate and you may choosing the right DeFi system tends to make otherwise crack disregard the method. With conventional loan providers dropping soil to innovative blockchain-dependent alternatives your’re likely thinking and therefore platforms are entitled to your own focus within the 2025.

Token delivery designs reveal the amount of real decentralization within this for every process. An educated systems dispersed governance tokens round the a huge number of proprietors as an alternative than just concentrating electricity certainly beginning teams otherwise investment capital firms. Compounding procedures supplied by complex programs speed up produce optimisation due to have including automobile-picking and you may reinvestment. You could potentially optimize productivity thanks to networks you to material benefits every hour or daily instead of requiring tips guide saying. Easy to use navigation distinguishes elite group programs from newbie plans attempting to get business. You could potentially select quality networks by their clean interfaces one screen trick metrics for example APY rates, liquidity depths, and you will deal will set you back instead of daunting tech slang.

A well-customized program enables you to execute investments, display screen their profile, and you will access industry study effortlessly. The big decentralized change programs focus on consumer experience, so it’s possible for someone to start change instead a steep understanding contour. Uniswap dominates the new decentralized replace field with $4.8 billion in total value locked round the its V3 method.